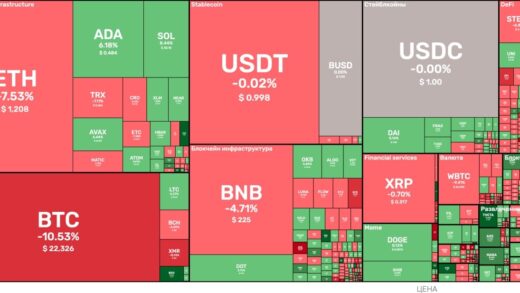

Ethereum fell lower on Thursday, as cryptocurrency markets continued to react to the latest U.S. retail sales figures. Sales in the United States fell by more than expected, coming in 1.1% lower in December. Bitcoin also declined in today’s session, with prices falling below the $21,000 mark.

Bitcoin (BTC) dropped below the $21,000 mark on Thursday, as crypto markets fell following slowing U.S. retail sales figures.

The decline saw BTC/USD hit an intraday low of $20,541.54 earlier in today’s session, fresh from a four-month high of $21,564.50.

Since the sell-off, BTC now seems to be in search of a support point, with the $20,500 mark a likely candidate.

Looking at the chart, a drop was somewhat expected with the 14-day relative strength index (RSI) tracking near a two-year high in recent days.

As of writing, the index is at the 78.40 level, which is marginally above a floor at the 77.00 mark.

Should a move below this point take place, it is likely that BTC bears could push prices towards the $20,000 zone.

Ethereum (ETH), which rose above $1,600 on Wednesday, was also in the red in today’s session, falling towards a five-day low.

Following a high of $1,602.11 on hump-day, ETH/USD dropped to a bottom of $1,509.42 earlier today.

As a result of the move, ETH fell to its lowest point since Saturday, when prices hit a floor of $1,449.

From the chart, ETH’s price strength has also hit a support level, with the RSI currently hovering close to a floor at 70.00.

Should momentum continue to trend downwards, the next signal will be that of the 10-day (red) moving average, which for now remains upward facing.

Providing this occurs, ethereum sellers will likely be targeting a move near the $1,350 mark.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Polkadot

Polkadot  Cosmos Hub

Cosmos Hub  Flow

Flow